UK SMEs optimistic about 2025 growth prospects

More than two-thirds of UK SMEs anticipate positive revenue growth in 2025, according to new research by Growth Lending. While 40% of businesses expect revenue growth of 5-10% over the next 12 months, a more ambitious 24% forecast growth of 10-25%.

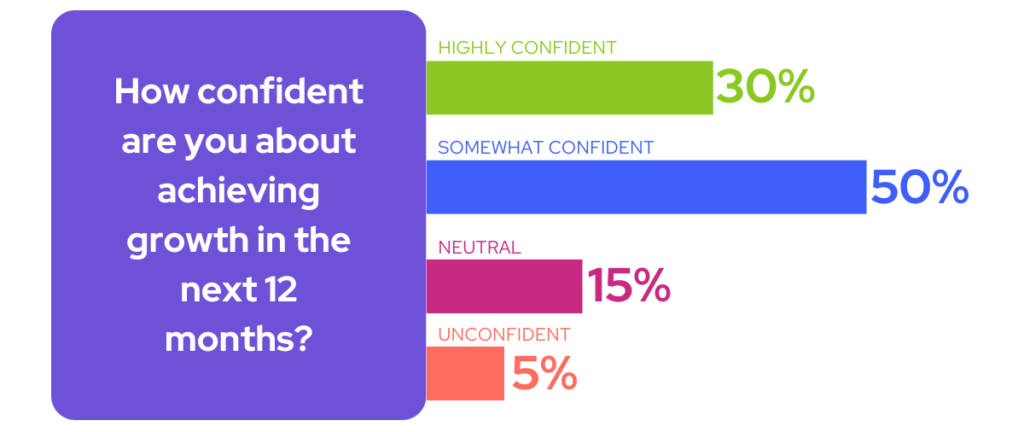

The Geared for Growth 2025 report has revealed insight into the mindset and strategic plans of UK SMEs as they navigate the complexities of the current economic landscape. The good news is that despite prevailing uncertainties, SMEs are optimistic about their growth prospects for 2025. This optimism is not merely speculative, but grounded in the proactive steps SMEs are taking to invest in their growth.

Almost half of the SMEs surveyed are actively considering how they can invest in growth, indicating a strategic shift towards expansion despite the economic challenges. A key area of focus is technology, and research and development (R&D), with 30% of respondents intending to allocate resources to these activities. It is a positive step forward from the caution we have seen in recent years, as this type of investment not only enhances business operations but also drives innovation, a vital component for long-term success in a competitive market.

Securing funding is another critical aspect of SMEs’ growth strategy. The report reveals that 18% of SMEs see securing funding as their top priority for supporting business growth. This emphasis on financial stability underscores the importance of access to capital in navigating economic uncertainties and capitalising on growth opportunities.

Commenting on the findings, Kimberly Martin, Managing Director at Growth Lending, said: “Our research underscores the resilience and forward-thinking nature of UK SMEs. Despite continuous economic challenges, these businesses are proactively seeking ways to invest in growth and drive innovation.

“However, it is clear that SMEs remain cautious in their approach. While this is understandable amid rising costs and geopolitical uncertainty, the right funding solution can play a crucial role in supporting businesses to to drive their growth strategies forward. Our research reveals that the challenges surrounding access to funding still persist and awareness of alternative sources of capital remains relatively low. As business leaders’ strategic priorities evolve in 2025, supporting them with flexible funding solutions and raising awareness of such support will be crucial in helping them to overcome economic uncertainties and achieve their growth goals in 2025.”

- Discover more SME growth insights by downloading the Geared for Growth report

- Or, get first-hand advice on fuelling your business’ growth by speaking with one of our lending experts