More than money:

How lenders can bridge the gap in the SME funding ecosystem

It is not revolutionary to say that there is a gap in the SME lending ecosystem. In fact, the Bank of England sizes the gap at a whopping £22 billion.

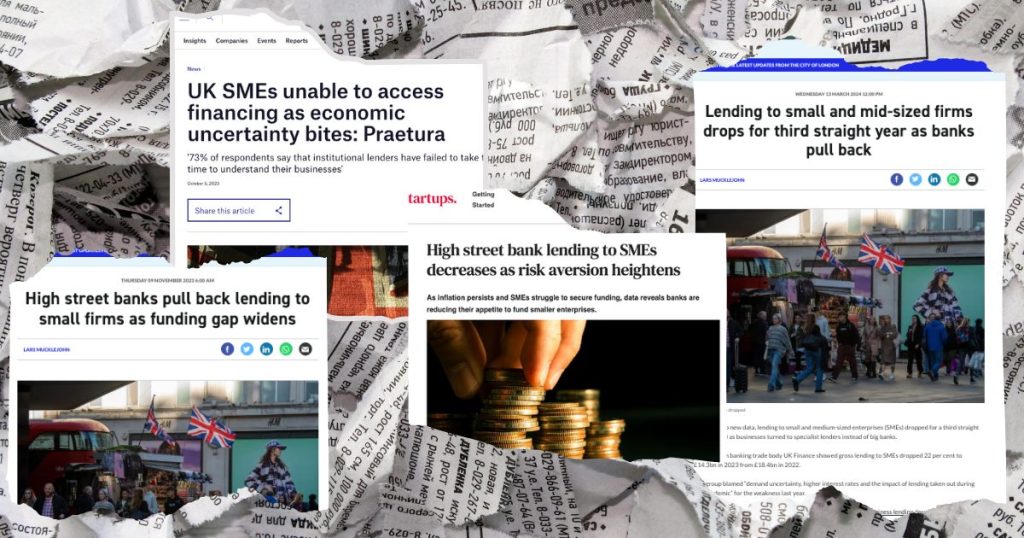

With stories of banks receding from the SME lending market and growing businesses finding it more and more challenging to secure funding, there is a temptation to believe that the outlook for growing businesses is a bit bleak.

Fortunately, this isn’t actually the case. There are many lenders doing great work to bridge the funding gap, but with business leaders still reporting a struggle to find finance, do these lenders need to do more to educate the market on what is available?

We explore three core messages that the alternative finance sector wants SMEs to know, in the effort to better-educate the market that if there is a gap, there is a bridge too…

1. The funding ecosystem is evolving – and so are alternative lenders

While the withdrawal of major banks from the SME lending market during the past couple of decades – and particularly in the past few years – is no good thing, what it has created is an opportunity for new disruptors to emerge. And these disruptors, known by most as alternative lenders, have become one of the fastest growing sectors within UK finance, worth roughly £6.26 billion at the end of 2023.

Far from being put-off by a constantly evolving ecosystem, these lenders look to consistently enhance their USPs, providing new solutions to either underserved areas of the market, or in instances where businesses typically struggle to raise finance.

Examples of this more agile approach to SME lending include:

- Revenue based finance

Early stage consumer businesses have historically struggled to raise capital due to their asset-light balance sheets. Revenue based finance enables these businesses to raise debt by leveraging their future revenues, advancing their income so they can invest in growth initiatives much earlier. This is particularly beneficial for fast-growing businesses that really need the extra working capital, or money to re-invest, so that they can continue winning clients and scaling their operations. - Asset based lending

While the invoice finance side of asset based lending is far from a “new” product, the need for differentiation in an increasingly saturated market has led to the emergence of sector-specific funders, which either have specialist knowledge of these industries, or are perhaps providing a unique finance product to an industry that would have historically been left untouched by lenders. - Term loans, growth loans and growth credit

As bank lending appetite continues to steer away from SMEs, these loans give fast-growing businesses the opportunity to raise significant sums and repay as they would a conventional bank loan. What is more, the lenders offering such loans are usually highly experienced at lending to SMEs, enabling them to take a more flexible approach to lending criteria, which encompasses high quality, but perhaps less established firms.

And this is by no means an exhaustive list. The nature of alternative lenders makes them more agile than the high street banks – they can adapt quickly to the changing needs of SMEs, with new products and approaches being introduced all the time.

2. We need to dispel debt as a dirty word

The growth of the alternative lending market is fantastic news for small and medium businesses seeking capital, but if these businesses are to truly benefit, more must be done to dispel the negative connotations of capital secured via debt.

Many business leaders have preconceived ideas of what raising finance via debt means and these misconceptions need to be corrected.

Misconception 1: Debt is expensive

A common misconception is that debt is a very expensive way of raising finance and truthfully, borrowing capital is more expensive at this moment in time than it has been historically, simply because bank base rates across the globe are inflated compared to that of recent years. Naturally, this additional cost is passed on to the borrower.

The borrower, eyeing up the repayment schedule, with capital plus interest repayments, thinks that equity finance, where no repayment is required, is a much cheaper alternative.

But the reality is that equity can be just as costly, if not more so, when you consider the full lifecycle of the investment.

In a successful, growing business, the slice of equity that founders concede to investors when they are initially fundraising, is typically worth considerably more than the equivalent debt repayments that would accumulate within a debt facility of a similar term.

Yes, the business needs to consider the serviceability of the loan, alongside running and growing their business, but if they can afford to do so, capital via debt is likely to be the less expensive option in the long run.

Misconception 2: Debt should be the last resort

Perhaps because of the negative connotations of personal debt, there is similar stigma attached, wrongfully, to debt within a business environment.

While business owners should of course be wary of over-leveraging themselves and taking on unnecessary debt, the corrected debt product, for the correct use, within a sensible and realistic growth strategy can be the difference between success and stagnation.

High performing businesses are an attractive proposition to debt providers, as fuelling the next phase of a growth strategy is exactly how debt can, and should, be used. These businesses can therefore obtain competitive offerings from alternative lenders, even where they do not meet the eligibility criteria of a conventional bank.

Misconception 3: Debt is restrictive

Some management teams wrongly assume that with debt finance come a number of covenants or conditions that mean they’ll spend more time reporting on performance than they will on growing the business.

Unlike in equity scenarios, many debt providers will not take a seat on the board, or get involved in the day-to-day running of the business. Generally, they choose to partner with a business because they believe in the management team, their vision, and their capacity to execute it.

3. Alternative lenders should commit to clarity and transparency

SME debt finance is a widely misunderstood area of the sector, with vast numbers of businesses unaware of the funding options available to them. Because it is an emergent part of the sector, there is also geographical disparity, where the areas of the country with strong professional services networks (London, Manchester, Birmingham, Bristol) have a greater awareness of the breadth of finance options available to SMEs than the areas without.

To bridge the gap in the funding ecosystem across the whole of the UK, lenders must work closely with their partners (advisors, accountants, lawyers, brokers) and attempt to expand these networks beyond the major cities, to ensure that regional businesses are able to access the same kind of financial support that is available to those in London and elsewhere.

Beyond improved communication with partners, lenders also need to be better at communicating their core messages to their target market – the SMEs. Alternative lending is now such a wide and varied category, with lenders differentiating on product, quantum, sector, growth profile and everything in between. Lenders need to be clear and transparent about exactly what it is they are offering and who they are offering it to.

Final thoughts

There is a gap in the funding ecosystem for UK SMEs. But alternative lenders such as Growth Lending are bridging this gap.

If you are interested in any of the points made above and would like to find out more, either as a business leader, or a financial partner, we’d love to hear from you.