Raising growth capital: What gets lenders excited?

In a challenging fundraising environment, these are the things that SMEs can do to put themselves in the strongest position

With the Bank of England sizing the funding gap for UK SMEs at more than £22 billion, it is inevitably difficult for growing businesses to find and secure capital.

But while the major banks retreat from the SME lending market, there are plenty of alternative lenders stepping up to the plate, which means SMEs do have options. They just need to put themselves in the strongest position to give themselves the best chance of success.

Here are the key business characteristics that get lenders excited, for you to consider during your fundraising journey…

1. Strong momentum

All lenders like to invest in companies that have strong momentum, but even more so when they are offering growth capital. Growth lenders want to see that trading is on the up and that this is forecasted to continue.

Growth lenders are investing in your company’s future growth, rather than your past performance, so strong momentum provides confidence that a) you are a good investment that will bring upside to the lender and that b) you will be able to repay any capital that you borrow.

2. Scalable business

In general, growth lenders are attracted to scalable business opportunities because they offer a risk profile that is well matched to growth capital.

A scalable opportunity is one where the business is fully proven and successful, but needs additional resources to expand. For example, it may need to increase sales staff, invest in production capacity, or replicate a service in new locations. From a growth capital provider’s perspective, this is an opportunity for clear growth and controlled risk, as the company is simply doing more of what it is already very good at.

3. Hot markets

Being in a hot market makes it more likely that the company will be successful. It will find it easier to scale and it will have more chance of achieving a highly valued exit because such markets attract equity financing and M&A activity. Companies active in hot markets can easily reach annual growth rates of 50% to 100%.

Examples might include:

- Businesses building a leading position in an emerging market

- Businesses offering a disruptive service in an established market

4. High gross margin

High gross margin businesses are well-suited to growth debt because they service fixed repayments of the debt more easily.

A high gross margin is often an indicator that your company delivers high value-added services to its customers. This is evidence of the longevity of the business model and also provides some headroom for lower margins if competition increases.

In addition, lenders like the fact that in a downside scenario, it is easier to support or save such companies because it is easier to act on overheads than on variable costs.

5. Recurring and predictable revenue streams

Growth lenders love business models with recurring revenues, because a company scales faster when it only has to win customers once. Recurring revenue streams are also more predictable. This attribute gives the lender visibility of the company’s future cash-flows and its ability to service debt. Businesses in this category include:

- Software-as-a-Service (SaaS) enterprises

- Businesses with long term contracts – these businesses often have long sales cycles, so you will need to demonstrate a strong pipeline to support growth forecasts

- Companies with low churn and good organic growth with existing customers

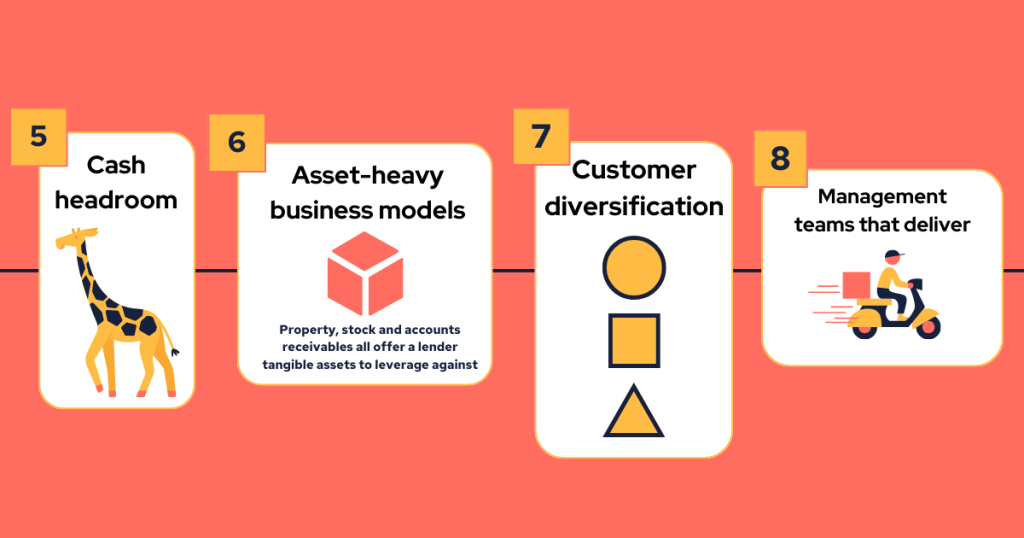

6. Cash headroom

Cash is king for growth lenders. A business plan showing clear cash headroom will ensure the lender is comfortable about your ability to service the debt and react appropriately in a downside scenario.

7. Asset-heavy business model

Downside protection is very important to growth lenders. It is easier to lend to companies with tangible assets – property, stock, or account receivables, for example, that the lender will rate as high-value collateral.

Specific situations that growth lenders like include:

- Funding equipment or hardware that is needed to accelerate growth

- Funding stock that is needed to increase sales

- Funding working capital where revenues are recognised ahead of receiving payments

8. Customer diversification

A business with good customer diversification will be considered a well-proven model and less risky. For companies with long sales cycles, the expectations in terms of customer concentration tend to be lower.

9. Management teams that deliver their business plans

When approaching a growth capital investor, having evidence that you have already delivered on your business plan and achieved what you set out to can immediately create a positive impression. This can prove vital for businesses that reach out to a growth lender six to 12 months ahead of actually being in a position to start the fundraising process.

There is a large upside to delivering on your plans – or in exceeding them. Doing so is rare and lenders will give you credit for your ability to make accurate forecasts. They will feel more confident about your future growth plans.

What next?

If you’ve been reading through this list thinking, “yep, that sounds like us,” then get in touch – we’d love to find out more about your business and how we might support you on the next steps of your growth journey.