The Growth Lending Guide to Export Finance

Find out what export finance is, how it works and how it can benefit your business

Long payment terms can create challenges for your working capital, particularly if you export products or services. The upfront costs associated with producing and shipping goods can be a difficult thing for a business to navigate.

Export finance can help with this, releasing working capital that would otherwise be tied up in invoices or purchase orders.

What is export finance?

Export finance is a cash flow solution aimed specifically at businesses that export. It facilitates the commerce of goods internationally by enabling you to overcome long payment terms from your customers.

Types of export finance:

- Pre-shipment finance: provided when exporters need funds before the shipment of products or goods.

- Post shipment finance: provided after the shipment of products or goods.

- Finance against collection of bills: in the case of international export, exporters can obtain a loan from the bank against those bills sent for collection.

- Finance, gains, allowances and subsidies: government provides subsidies to the exporters to enable them to sell the goods at a reduced price to importers.

- Discounting letter of credit: consists of security from the issuing bank regarding making payment.

How does Growth Lending’s export finance work?

After your export business has set up payment terms with an overseas customer, which is typically between 90 to 120 days, it might struggle with its cash flow because of the delay between shipping goods and receiving payment.

Issuing your unpaid invoices to an invoice finance provider like Growth Lending, will enable you to bridge the working capital gap that late payments create.

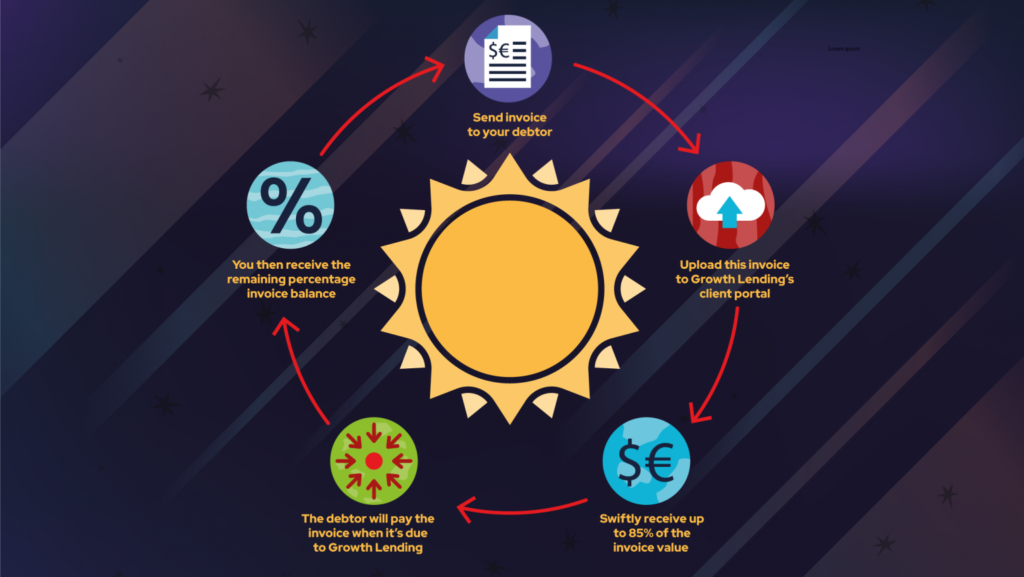

Our export finance is simple:

- Send an invoice to your debtor in USD or EUR

- Upload this invoice to Growth Lending’s client portal

- Swiftly receive up to 90% of the invoice value

- The debtor will pay the invoice when it’s due into a Growth Lending trust account

- You then receive the remaining percentage balance minus fees

Benefits of this type of export finance

- It is accessible to more businesses, as opposed to a bank loan that requires more trade documentation and greater security to access funds

- You only pay for the finance you need by choosing which invoices you want to fund to keep costs low

- It enables you to access working capital more quickly, which can be used to:

- Smooth out cash flow

- Supply more businesses and pursue bigger growth opportunities

- Minimize risk of non-payment if bad debt protection is included

- Purchase more stock at a faster rate and store it to plan for contingencies

- Reinvest in headcount and grow teams

- Fund potential acquisitions, MBOs and MBIs

Why choose Growth Lending to fund your export finance?

We can fund invoices in USD and EUR for businesses based in the US, UK and Germany, as well as other OECD countries on request. This means you don’t need to find multiple lenders across different jurisdictions to support your cross-border sales for a more streamlined funding process.

Growth Lending also does not need to fund all of your invoice finance requirements. If you already have a lender in place to support your business, but need further support for invoice finance in USD or EUR, we can operate these as standalone facilities.

Our expert team can guide you through the process from start to finish and structure your facility to suit the needs of your growing business – if these needs change, your facility can too.