What stage of growth is my business at and why does it matter?

Raising capital is an important part of accelerating a business’ growth, but to be able to do this successfully it’s useful to know what stage of growth your business is currently at.

If you’ve launched your business fairly recently, answering this question might feel easy. But for businesses that are more established working out where you sit on the growth scale – and therefore what type of funding is likely to be most transformative – can be more complicated.

Each stage comes with its own challenges, opportunities and strategic priorities, so understanding each of them is crucial for making the right decisions at the right time. In this article we’ll outline the main stages of business growth, how to identify where you sit and, most importantly, what this knowledge enables you to achieve.

What are the stages of business growth?

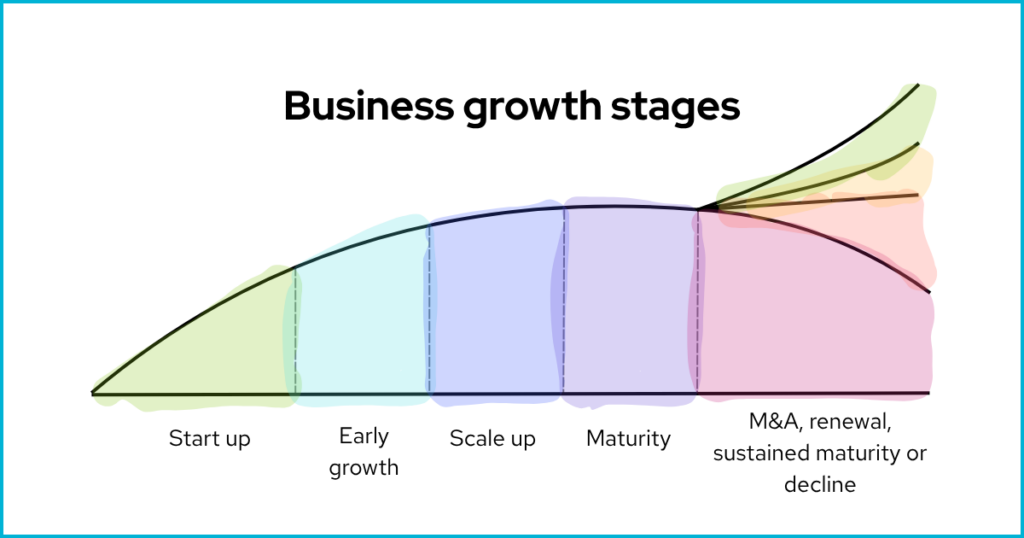

While every business journey is unique, most follow a similar growth trajectory. These growth stages generally include:

Start up

The focus here is proving your concept. You’re answering questions like: Does my product or service solve a genuine problem? Is there a viable market? Would my product or service be able to compete? This stage is characterised by experimentation, uncertainty, and often, minimal revenue.

Early growth

The business has established product-market fit and is generating consistent revenue with growing customer traction. It is likely still loss-making or only modestly profitable. The team remains small and agile, with an increasing focus on scaling sales and delivery in a controlled manner. Maintaining quality while building scalable processes becomes a key priority.

Scale up

Once you’re more certain about your proposition, the business begins to scale. Revenues increase rapidly, the team expands, and operational complexity rises. However, this is also when cash pressures can intensify, as businesses often reinvest to fund expansion, or face increased overheads to take on larger contracts. Working capital management is key.

Maturity

At this stage, the business has a reliable customer base, consistent revenue, and ideally, profitability. The focus shifts from rapid expansion to optimising operations, increasing margins, and maintaining market position. Businesses looking to expand at this stage will likely need to look to new markets or new verticals for growth. The goal is to expand market share and revenue streams without losing stability.

Sustained maturity, renewal, M&A or decline

Beyond maturity, businesses face a fork in the road:

- Sustained maturity: Continuing with solid profits and incremental improvements – a tricky thing to execute in fast-moving and highly-saturated sectors where competitors are continuously evolving.

- Renewal: Reinventing or innovating offerings, entering new markets, or evolving business models to stay relevant – often a necessity in the types of markets mentioned above.

- M&A: Mature businesses often turn to mergers and acquisitions for expansion. M&A can provide a rapid route to expansion, enabling a business to gain market share and enter new markets or verticals quickly.

- Decline: Where businesses don’t adapt to consumer demand or keep pace with the competition, they risk falling behind and losing their share of the market.

Not every business will experience these stages in a clear linear way. Some companies may iterate between phases (e.g. a “second startup” to launch a new product while still running a mature core business). But broadly, these stages capture the evolution from start up to established enterprise.

Why understanding growth stages matters

Many small businesses don’t survive long enough to see maturity. A common culprit is operating out-of-sync with your actual stage of growth. For example, hiring aggressively or scaling-up before achieving product-market fit.

Recognising the reality of your current stage therefore enables you to:

Prioritise effectively

While every business leader wants to drive profits eventually, if you have only just launched your business, your energy is best focused on ensuring a great product-market fit and identifying ways to make your offer more compelling to potential customers.

If you are more established, have a good sense of your position in the market and have strong cash flow, priorities will likely shift towards optimising profits.

A good leader cannot do everything at once and knowing what activities are going to impact your growth the most enables you to prioritise accordingly.

Pursue the right type of funding

A part of prioritisation will mean deciding when and how to fund the business’ growth. In the earlier stages, bootstrapping, angel and equity investment are all commonplace, particularly for tech-enabled businesses that require significant investment to get their product or service off the ground.

At the more established end of the scale, where a business has a strong performance history, bank loans might be more accessible and affordable. But for businesses between either end of this scale, knowing what type of funding will best support your business can be more complicated. Businesses with stable cash flows may look to introduce amortising debt whilst businesses that cannot sustain regular capital repayments may want to consider alternatives such as receivables and asset finance.

Knowing what stage of growth your business is at empowers you to research the most relevant options – you can find out more about these here.

Set realistic goals and KPIs

5x growth, while ambitious, might actually be possible for earlier stage businesses, because of the point that they are starting from. Particularly if they have been savvy at identifying a gap in the market. But exponential growth in the latter stages is much harder to come by.

Knowing where you are at in your growth trajectory enables you to set realistic goals and KPIs. Unrealistic goals can lead to inefficient resource planning and demotivated staff.

Avoid common missteps tied to premature scaling or stagnation

Businesses face all kinds of challenges when they try to scale too quickly, but equally, at the other end of the scale, the divide between stability and decline is slim.

Clarity of your current position and immediate growth goals helps avoid common pitfalls such as taking on clients that are too large for your current capacity, or becoming complacent with reinvestment and falling behind your competitors (you can read more about the risks of over-reliance on organic growth here).

How to tell what stage your business is at

There is no single metric that defines each growth stage, but a combination of factors helps paint a picture. Ask yourself the following questions:

- Is my proposition still evolving, or is it stable and proven?

- Is my revenue low or inconsistent, or am I seeing steady growth every month?

- Is the business profitable, breaking even, or still re-investing in growth?

- Is my cash position improving, or am I constantly bridging gaps?

- Do I have scalable systems and processes in place? A growing team?

- What is my trajectory? How fast and sustainably is the business moving in the right direction?

- Where does most of the decision making sit? Do team members wear many hats or are there specialised teams or departments in place?

Fast-growing tech businesses, for example, might skip the traditional slow climb and blur the lines between startup and growth. In contrast, a manufacturer or care home business, with capped capacity, might hit maturity early and then plateau unless they expand sites or services.

Strategic focus by growth stage

Startup – Prove the concept. Understand your market. Build a compelling story. Be ready to pivot.

Early Growth – Solidify your business model. Invest heavily in sales and marketing. Establish processes and workflows.

Scale up – Scale operations. Manage cash flow and working capital. Forecast aggressively. Preserve culture and innovation even as headcount soars.

Maturity –Optimise for profit. Focus on margins, internal efficiencies, and governance. Identify new customer segments or markets.

Renewal – Reinvest in innovation. Pivot offerings, explore new products or adopt new business models. Consider strategic acquisitions or partnerships to rejuvenate the business.

Decline – Develop a turnaround strategy or risk obsolescence. Cut costs or transform operations.

Preparing for the next phase of growth

Continuous growth is difficult without continuous investment – whether that be in innovation, research and development, or M&A and expansion activity. This means that it is essential to have a clear plan for how you will fund your growth.

If you are interested in learning more about growth capital and what it could do for your business, you can book a slot to talk to me directly here, or get in touch with another member of our expert lending team.