Knowledge bank

Featured Post

What are the best funding options for B2B businesses?

Securing funding is a powerful way to accelerate growth, but with more options than ever before it can make the process challenging to navigate – we address some of the common funding options for B2B businesses.

Read more

Insights

New report: The Cost of Caution

Our latest report provides one of the clearest pictures to date of how UK SMEs perceive debt finance, and the opportunities they risk losing by delaying securing funds. Download your copy now.

Read more

Insights

What is Mezzanine Financing?

Mezzanine financing is a flexible growth-funding option that bridges the gap between senior debt and equity. Often used for acquisitions, management buyouts, and real estate development, it allows businesses to raise additional capital without giving up control. In this guide, Growth Lending explains what mezzanine finance is, how it works, its key benefits, and when it’s the right solution to help your company expand.

Read more

Insights

How Do We Close the Funding Gap?

SME funding has never been more abundant. Yet for many founders, securing the right capital still feels harder than ever. We share 4 ways that we can help to make SME funding simpler and smarter.

Read more

Insights

How to know when your business is investment ready

Securing capital is a transformative step in a business’ growth journey, but how do you ascertain when it’s the right time to raise funds and, crucially, whether your business is appropriately prepared? We share the six key signs that your business is investment ready.

Read more

Insights

What to consider when acquiring a healthcare business

The UK’s ageing population is driving increased demand for residential care, creating opportunity for the UK’s operators. We examine the key things they need to consider when planning for expansion via acquisition.

Read more

Insights

How to navigate an organisational culture change

When a new owner steps in after an acquisition, culture will shift whether intentionally or not. Organisational psychologist Heather Worsfold explores how you can make the most of organisational culture change.

Read more

Insights

Raising funds without tangible assets

Over the past few decades, the UK economy has undergone a significant transformation, with services now accounting for approximately 80% of GDP. But have our lending models kept up? We explore the options for asset-light businesses trying to raise capital.

Read more

Insights

What the 10 Year Health Plan means for care home operators

The government announced its ambition to “bring health services to people’s doorsteps” in its new 10 Year Health Plan – discover what this means for private healthcare operators.

Read more

Insights

What stage of growth is my business at and why does it matter?

Raising capital is an important part of accelerating a business’ growth, but to be able to do this successfully it’s useful to know what stage of growth your business is currently at. We outline the main stages of business growth, how to identify where you sit and, most importantly, what this knowledge enables you to achieve.

Read more

Insights

How much should my business borrow?

Raising funds is a critical lever for business growth, but deciding how much to borrow can feel like walking a fine line between ambition and overextension. We explore the key questions to ask before you begin the fundraising process.

Read more

Insights

How to build a strong management team

Discover the roadmap to building sturdy and sustainable leadership, from an Organisational Psychologist.

Read more

Insights

What are the best funding options for B2B businesses?

Securing funding is a powerful way to accelerate growth, but with more options than ever before it can make the process challenging to navigate – we address some of the common funding options for B2B businesses.

Read more

Insights

Why are we all so obsessed with organic growth?

In this article, we’ll explore why the reverence of organic growth may be problematic in today’s economic context, misconceptions around organic growth and why external funding can often be a smarter path to scaling a business.

Read more

Insights

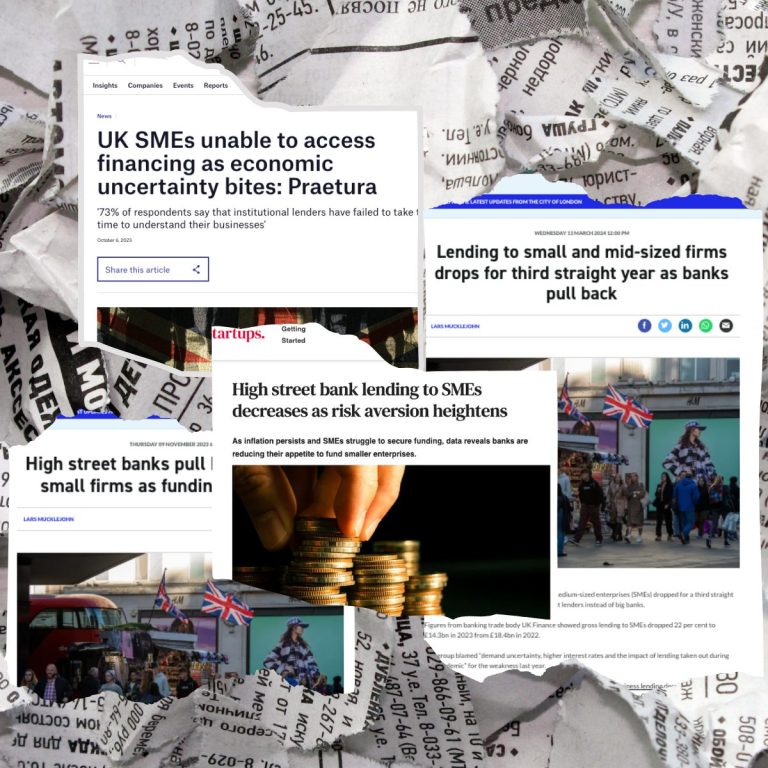

Why is the “funding gap” such a problem?

Despite a greater availability of funding options than ever before and funders insisting that they have plenty of liquidity, business leaders, advisors and lending professionals frequently cite the “funding gap” as a significant barrier to growth. But what exactly is the funding gap, and why does it pose such a problem?

Read more

Insights

Growth credit vs traditional loans: Which is right for you?

Choosing the right funding option is a crucial decision for any business leader looking to scale. We explore the key differences between growth credit and traditional loads, helping you determine which option best aligns with your business goals.

Read more

Insights

Key challenges for healthcare businesses in 2025

We take a look at the top five areas that health-orientated firms should consider as part of their strategy in the next 12 months.

Read more

Insights

What is growth credit and how can it support my business?

We cover some of the key characteristics of growth credit, how it benefits growing businesses and the types of firms it is best-suited to, to help demystify the funding landscape and help you navigate it more easily.

Read more

Insights

How to ensure your business is investment ready

Securing investment is a critical milestone for many businesses, but the process can be challenging. We share some of the key ways your business can get “investment ready” to help things run smoother.

Read more

Insights

Why is M&A a good strategy for business growth?

Mergers and acquisitions can be a game-changer for businesses looking to scale quickly and efficiently, but they’re not without their challenges. We weigh up the benefits and pitfalls of M&A and explore how to identify the perfect acquisition target.

Read more

Insights

Types of growth capital

Navigating the funding landscape is always tricky, not least because of the variety of options available to businesses. We break down the different types of growth capital to make this easier.

Read more

Insights

Everything you need to know about acquisition finance

Acquisitions are a tried and tested method for accelerating business growth. Thinking about growing your business via M&A? Here is everything you need to know about securing acquisition finance…

Read more

Insights

Working capital: Why is it important for business growth?

Working capital is a fundamental part of any business’ success, but what about the specific impact that working capital can have on a business’ growth? And how can businesses use working capital most effectively to accelerate this growth? We break it down…

Read more

Insights

Raising growth capital: What gets lenders excited?

In a challenging fundraising environment, SMEs need to put themselves in the strongest position of securing capital. Here are the key business characteristics that get lenders excited, for you to consider during your fundraising journey…

Read more

Insights

How to execute a successful acquisition

Acquisitions can be a powerful way to accelerate your company’s growth, enabling you to quickly scale operations, enter new markets and achieve other strategic goals. But successful M&A requires careful planning. We share our step-by-step guide to getting it right.

Read more

Insights

Fuelling business growth: When is venture debt the right option?

There are so many funding options available to businesses that it can feel tricky trying to navigate them all. We unpack the details of venture debt, which businesses it is best suited to and how it can be used to accelerate growth.

Read more

Insights

How to use growth capital

How can business leaders use growth capital to enhance their outcomes? Why would a business actually raise growth capital? And what are the key things business leaders should be aware of, ahead of a growth capital fundraise? We answer all this and more.

Read more

Insights

More than money: How lenders can bridge the gap in the SME funding ecosystem

With SMEs consistently struggling to access finance, the fact there is a gap in the funding ecosystem is not in doubt. But what can lenders do to improve this situation? How can they bridge the gap?

Read more

Insights

How do I know when it’s the right time to raise capital?

A lack of investment can cost businesses their growth, but how do you get the timing right? We uncover the key characteristics of a business that is ready to raise capital.

Read more

Insights

Decision making for entrepreneurs

Sometimes making easy decisions is the hardest thing for entrepreneurs to do. Take advice from a psychologist on how to work your decision making muscles.

Read more

Insights

Is your management team strong enough to impress investors?

Discover the management team qualities that investors are looking for when they assess your business.

Read more

Insights

The role of brokers in securing SME funding

Growth Lending works with brokers and intermediaries regularly – they are a hugely important part of the funding ecosystem that has developed around small and medium-sized enterprises that are looking to grow.

Read more

Insights

The difference between debt financing and equity financing

Debt or equity? This guide breaks down the difference between the two, as well as the advantages and disadvantages of each.

Read more

Insights

Ad Tech Industry: All You Need To Know

Ad tech is the short term for advertising technology, and refers to the technologies and software used for delivering online ads. Discover all you need to know, here.

Read more

Insights

How to build a diverse team

When it comes to recruiting, it should always be done with an open mind. Discover the importance of building a diverse team, and the benefits it will bring to your business.

Read more

Insights

The Story of Our Culture | Growth Lending

With culture an integral part of the fabric of Growth Lending, Organisational Psychologist Heather Bingham reveals exactly how our culture was curated and what it means for the organisation.

Read more